Verity Global Solutions

Mortgage Accounting services

Verity is a labor and automation solution provider. Our clients outsource workflows to Verity’s offshore team or utilize Verity’s robotic process automation technology to achieve the lowest cost of production.

Schedule a Free Consultation to see how Verity can help you grow.

Why Verity?

The mortgage industry is changing

Verity is a labor and automation solution provider. Our clients outsource workflows to Verity’s offshore team or utilize Verity’s robotic process automation technology to achieve the lowest cost of production.

We offer a full suite of solutions to meet your needs, including loan origination, loan servicing, title work and real-time, AI-powered pre- and post-close quality control services.

With Verity on your side, you’ll be able to focus on what matters most – growing your business and taking care of your customers.

You deserve an easier way to do business. Let Verity Global Solutions take care of all those tedious tasks for you so you can get back to business.

Schedule a free consultation today to see what Verity can do for you.

Mortgage Accounting Services

Verity has a team of experts in mortgage accounting who are fully trained in AMB, Loan Vision, QuickBooks as well as various mortgage LOS’s and servicing systems. Verity helps with commission calculation, MI payments, GL entries/transaction posting and more at a fraction of the cost. Accounting is one of the most commonly outsourced functions. It is difficult to find good, experienced mortgage accounting personnel skilled in AMB/Loan Vision.

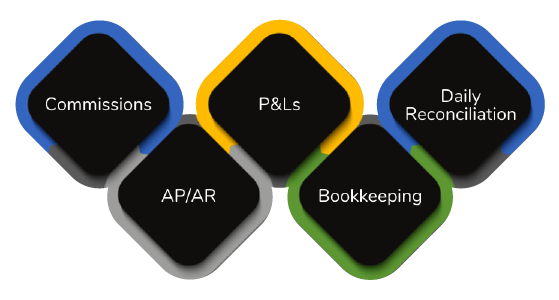

We provide:

Loan Level Reconciliation with LOS & Loan Level Accounting of Expenses.

Vendor Reconciliation AP Aging Report weekly and analysis

Trend Income Statement & Balance Sheet Analysis MIS Reporting.

UHS Bundle Upload & HMDA -1098 and any Year end assistance to CPA if required.

Partial list of functions:

Vendor Setup

Purchase Advice Pull Down

Purchase Import

Payroll Journal Entry

Branch Reports

MCC Fees

KPI / Reporting

Appraisal Fee Review

GL Reconciliation

Mortgage Insurance Payments

Tax Support

Daily Reconciliation

AP/AR

With Verity, you can save approximately 60% utilizing our skilled workforce with critical functions like investor reporting or bank reconciliation functions.

– Ben Cheek, CEO of Genhomes Lending

How to get started

Initial Consultation

Scope definition

Process review and optimization

Cost modeling

Ramp Up

Onboarding

Define KPIs and SLAs

Production schedule

Introduce and integrate teams

Production

Quality and turn-time monitoring

Reporting

Product reviews

The Solutions You Need.

Origination | Servicing | Title | QC | Accounting | Encompass® | RPA

Don't take our word for it. Here's what our customers have to say.

After six months of working with outsourcing, Plains Commerce was able to clear up 95% of all severe findings. After an additional year working with our outsourcing partner, we haven’t had a severe finding in eight months. Plains Commerce has been able to focus on fixing moderate and informational findings, making us more proactive and compliant.

-Katie Gibbons, Chief

Compliance Officer of Plains

Commerce Bank

“With KPO underwriting support, my employees may submit a file Wednesday night and come back first thing on Thursday morning and have a complete file and task list to close out the loan. This enables work to happen 24/7 behind the scenes while employees are still able to

go home on the weekends and return more refreshed and ready to tackle the day. In addition to cost savings, the enhanced operational efficiency created cleaner files from the beginning. It streamlined our operations, which resulted in a quicker turnaround time to fund the loans.”

- E. H. "Sonny" Bringol, Jr., Chairman & President of Victorian

Finance, LLC

"If you look at each individual task that goes into producing a loan, if those tasks are assigned correctly to either the outsourced team or my internal team, we achieve maximum cost competitiveness and the shortest time to close. I want my team performing higher value and strategic work, focusing on the borrower experience. Outsourcing supports us with an assembly line production of time consuming, repetitive work.”

- Ben Cheek, CEO Genhomes Lending

"With outsourcing, more menial tasks and busywork are outsourced, meaning the in-house staff is utilized for higher value work focused on the borrower experience and credit decisions. One of the benefits of outsourcing has been that our employees are happier and more fulfilled because they get to do the job they were hired to do, without the more mundane tasks. When their work is done, employees can leave the office on time, spending more time at home with family, and enjoying a better work-life balance even during volume spikes. Happier employees who can take time away from work to rest will come back more refreshed and ready to take on a new day. Due to the 24/7 flow of work from the outsourcing team, employees can take a vacation, use sick leave, and thoroughly enjoy their weekends before returning to work, with a checklist ready of what is left to complete. Rather than employees worrying about outsourcing taking their jobs, they feel a better sense of security, knowing they are needed and will be fully utilized despite the season."

-Kevin Heckemeyer, CEO of ResMac, Inc.