Verity Global Solutions

Robotic Process Automation (RPA) for the Mortgage Industry

Verity specializes in automating mortgage processes. Our clients utilize Verity’s proprietary robotic process automation (RPA) technology to achieve the lowest operating cost.

Schedule a Free Consultation to see how Verity can help you grow.

Why Robotic Process Automation (RPA)?

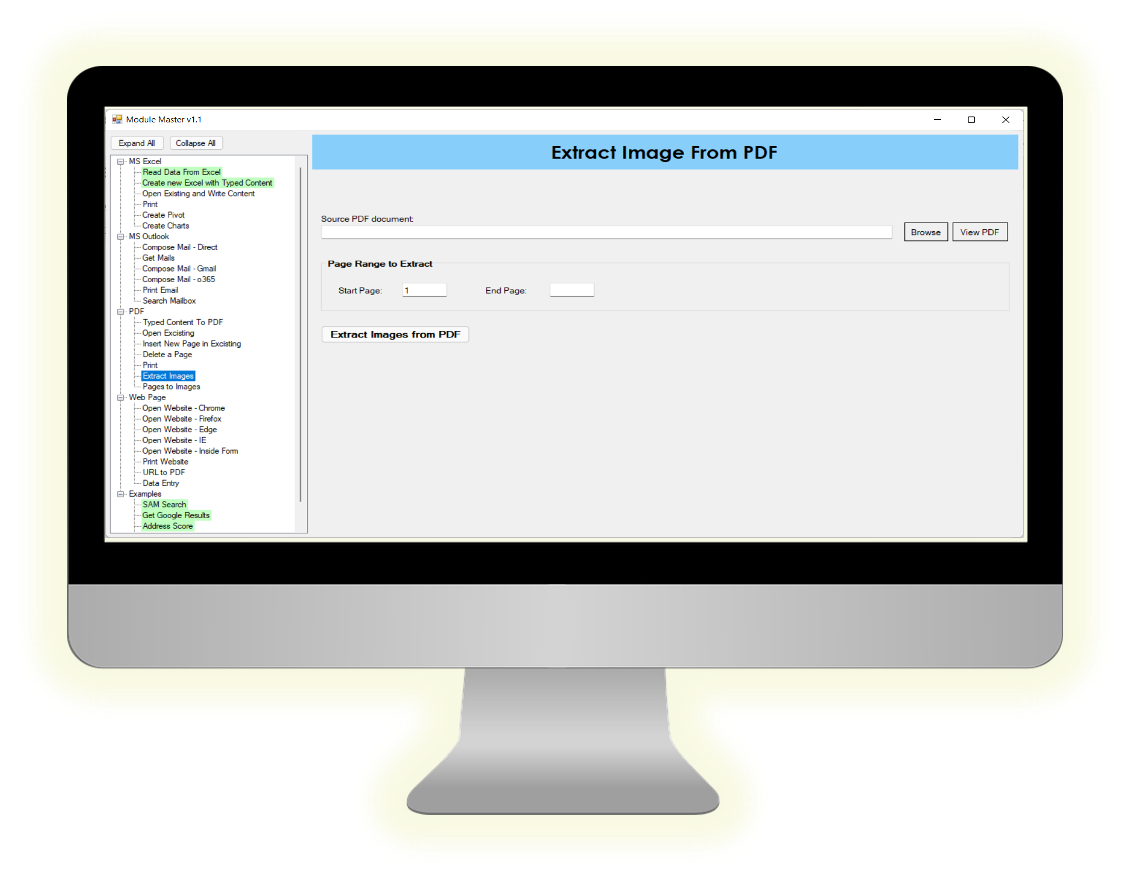

With RPA, you can automate highly manual, repetitive processes. Verity developed its own proprietary bot platform, bringing a new level of easy customization to deploying your own tech.

Through the study of over 200 back-office processes and the completion of numerous projects, Verity created a library of functions/bots that link together to produce comprehensive automated solutions. This library and our Six Sigma Black Belt expert team will transform your workflow, adding automation efficiencies in just the right places.

The Verity Automation Approach

Study process to identify automation opportunities

Redesign the process with automated steps

Standardize and customize

Rearrange process steps

Deploy bulk action vs. one-by-one

Configure BOT modules using the solution library to assemble function

Test, implement and hand over bot

Our RPA library also has AI capabilities like speech to text, speech-based action, optical character recognition and more.

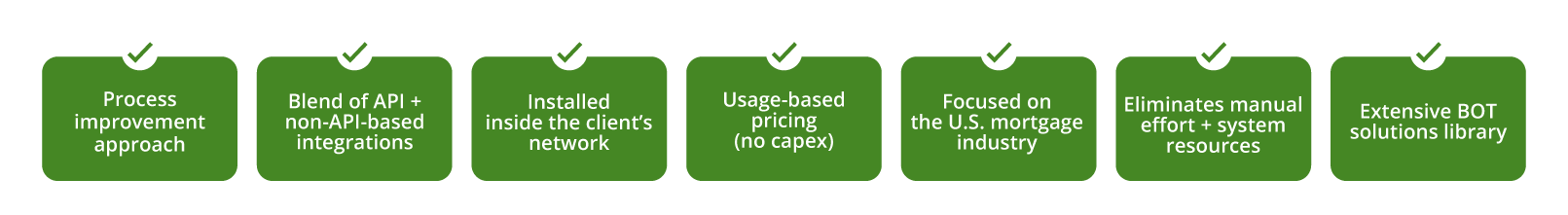

The Verity Difference

Our bots are

The Team

Our certified Lean Six Sigma Black Belt team has a manufacturing efficiency improvement mindset. We optimize the process before we automate it, ensuring your workflow is optimized to its full potential.

How to get started

Initial Consultation

Clients provide us with a wish list and/or videos of processes that are highly manual and repetitive. Verity evaluates and provides a roadmap for automation. Verity then develops and maintains the automation for the length of the engagement.

Pricing - No capex

Verity has pricing models available to automate your processes using transaction-based pricing with no upfront investment from our clients.

Scalable solution

Unlike traditional technology in the market, our solution scales on the fly to meet the cyclical demands of the mortgage industry so the cost is equitable with the demand.

Secure Service

Verity is certified to ISO 27001 and is SOC 2 compliant.

Success Story

A top 10 U.S. mortgage lender deployed Verity’s custom RPA solution for fraud detection, enabling them to reduce process time from 24 minutes to 15 seconds, saving them $1mm+ a year and counting as they scale. It took six weeks to develop.

The Solutions You Need.

Origination | Servicing | Title | QC | Accounting | Encompass® | RPA

Don't take our word for it. Here's what our customers have to say.

“With KPO underwriting support, my employees may submit a file Wednesday night and come back first thing on Thursday morning and have a complete file and task list to close out the loan. This enables work to happen 24/7 behind the scenes while employees are still able to go home on the weekends and return more refreshed and ready to tackle the day. In addition to cost savings, the enhanced operational efficiency created cleaner files from the beginning. It streamlined our operations, which resulted in a quicker turnaround time to fund the loans.”

- Sonny Bringol, Chairman & President

of Victorian Finance LLC

“If you look at each individual task that goes into producing a loan, if those tasks are assigned correctly to either the outsourced team or my internal team, we achieve maximum cost competitiveness and the shortest time to close. I want my team performing higher value and strategic work, focusing on the borrower experience. Outsourcing supports us with an assembly line production of time consuming, repetitive work.”

- Ben Cheek, CEO Genhomes Lending

“After six months of working

with outsourcing, Plains

Commerce was able to clear up 95% of all severe findings.

After an additional year working with our outsourcing partner, we haven’t had a severe finding in eight months. Plains Commerce has been able to focus on fixing moderate and informational findings, making us more proactive and compliant.”

- Katie Gibbons, Chief Compliance Officer of Plains Commerce Bank.

"With outsourcing, more menial tasks and busywork are outsourced, meaning the in-house staff is utilized for higher value work focused on the borrower experience and credit decisions. One of the benefits of outsourcing has been that our employees are happier and more fulfilled because they get to do the job they were hired to do, without the more mundane tasks. When their work is done, employees can leave the office on time, spending more time at home with family, and enjoying a better work-life balance even during volume spikes. Happier employees who can take time away from work to rest will come back more refreshed and ready to take on a new day. Due to the 24/7 flow of work from the outsourcing team, employees can take a vacation, use sick leave, and thoroughly enjoy their weekends before returning to work, with a checklist ready of what is left to complete. Rather than employees worrying about outsourcing taking their jobs, they feel a better sense of security, knowing they are needed and will be fully utilized despite the season."

-Kevin Heckemeyer, CEO of ResMac, Inc.